End of Financial Year – Time to Get Ready!

End of Financial Year – Time to Get Ready!

With 30 June 2019 almost upon us, preparations turn towards what needs to be done to be ready for the end of the financial year.

In this article we provide some ideas and tips that might assist with your end of financial year housekeeping, starting with rental property deductions and other areas of ATO scrutiny, including use of social media to confirm rental availability and Air BnB advert data matching!

We will also go over a few other areas of change to look out for in the following topics that may also affect you or your business:

- Instant Asset Write off

- Company Tax Rate

- Low and Middle Income Tax Offset

- Single Touch Payroll

- Information for Micro Businesses

- Deductions for Paying Employees

- Superannuation Issues

Rental Properties

This year the ATO is taking a closer look at rental property deductions. Last year the ATO started reviewing income tax returns with large rental property losses and found that errors were common.

This year the review and data matching process will be even stricter and wide ranging.

Last year, I wrote about two pieces of legislation that commenced from 1 July 2017, the non-deductible nature of travel to review properties and the non-deductible nature of depreciation of certain items of plant & equipment. Please be aware of these areas as mistakes were common in FY18.

Other areas that the ATO is scrutinising are:

- When is the property actually available for rent? The ATO is using social media and the internet websites to check dates of availability. Be careful when taking selfies in the pool over your holidays and telling everyone about it!

- Airbnb and other listing sites – and not declaring income. ATO is now data matching in this area.

- Interest on loans – and when private monies maybe mixed and/or used from the loans – is a non-deductible portion being calculated.

- Proportion of expenses for private use and how the private use is calculated. Also, is the property being rented out at market rates?

Instant Asset Write off

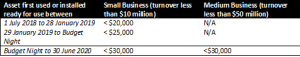

On Wednesday, 3rd of April 2019, the Governments’ proposed Bill to increase & expand the Instant Asset Write-Off for Small and Medium-Sized business was passed through the Senate.

The following outlines the proposals, which have now taken effect:

- The instant asset write-off threshold for small businesses (aggregated turnover of less than $10 million) has been increased, from 2 April 2019, to $30,000 for eligible assets that are first used or installed to use until 30 June 2020.

- Small business will be able to immediately deduct purchases of assets costing less than $25,000 from 29 January 2019 to 2 April 2019.

- Medium sized businesses – less than $50 million aggregated turnover – will be able to immediately deduct purchases of eligible assets costing less than $30,000 that are first acquired after 7:30pm on 2 April 2019 until 30 June 2020.

Please note that Small Business Entities (SBE) need to have elected to use SBE pooling in order to access the 100% write off.

With Medium Business Entities (MBE) the write off is compulsory.

Company Tax Rate

For FY19, the company tax rate for a small business entity is 27.5%.

The definition of small business entity for this tax cut, is a business with an aggregated turnover of less than $50million.

With the reduction in the company tax rate to 27.5%, a corresponding change in the level of imputation credits will also reduce to 27.5%. This reduction in imputation credits only applies to dividends paid from a Small Business Entity (SBE).

Other companies will still pay tax at 30% and payout franked dividends at 30% for FY18. Corporate beneficiaries and investment companies fall into this category.

Please note that under the new base rate entity calculations, your corporate beneficiary may now be taxed at 27.5% if it receives greater than 80% of its income from a small business entity (for example a trading trust).

Low and Middle Income Tax Offset

The Government will extend the Low and Middle Income Tax Offset (LMITO) by increasing the base amount from $200 to $225 per year and the maximum amount from $530 to $1,080 per year.

Taxpayers with income between $48,000 and $90,000 will be eligible to receive the maximum offset of $1,080. The offset phases out with incomes up to $126,000.

The offset will apply to tax returns lodged from 1 July 2019.

The Low and Middle Income Tax Offset is due to end on 30 June 2022.

The ATO will start full processing of 2019 tax returns on 5 July 2019 and expects to start paying refunds from 16 July 2019. The LMITO is not yet law, so lodging your tax return too early may result in you having to amend the tax return later once the law is enacted. The ATO has not yet advised its process around this issue.

Single Touch Payroll

The Federal Government passed legislation that requires employers of all sizes to electronically file each pay run with the ATO using Single Touch Payroll (STP) from 1 July 2019.

What does Single Touch Payroll mean?

The introduction of STP reporting will require you to send your employees’ payroll and super information to the ATO from your payroll solution each payday.

Single Touch Payroll reporting has been a mandatory requirement for employers with 20 or more employees since July 2018, however under this new legislation, will now include employers with employees totalling 19 or less.

What does STP Reporting mean for my business?

- Your payroll cycle will not change. You can still pay your employees weekly, fortnightly or monthly.

- Your payment due date for PAYG Withholding and Superannuation contributions will not change. However, you can choose to pay earlier.

- You may not need to provide your employees with a payment summary at the end of financial year for certain payments you report through Single Touch Payroll. The ATO will make that information available to employees through myGov.

- You will have the option to invite your employees to complete Tax File Number Declaration, Superannuation Standard Choice Form, and Withholding Declaration online. This feature will not be available immediately.

- When you report to the ATO through Single Touch Payroll, your employees will be able to view their year to date tax and super information through myGov.

Information for Micro Businesses

For micro employers with between 1 – 4 employees, a number of alternative options not available to larger businesses have been made available to assist in this transition.

Each of the following alternatives are listed below:

- An initial two year period has been granted to micro-businesses to allow your Registered Tax or BAS Agent to report your payroll quarterly (compared to each individual payroll run);

- An extension to 30 September 2019 to make the transition to real-time digital reporting;

- Ability to request additional time to commence STP reporting; and

- Micro businesses will not be subject to penalties for mistakes, missed or late reports for the first year.

In preparation for these legislative changes, it is important for you to enquire with your payroll software provider about how they will offer STP reporting – whether through an update to your existing software, or via additional services.

Additionally, check that your payroll staff are fully aware of these changes and informed about Single Touch Payroll.

As a business, you should ensure that you are:

- Paying your employees correctly.

- Calculating your employees’ super entitlements correctly.

- Addressing overpayments correctly.

- Maintaining accurate information including names, addresses, and date of birth records.

Deductions for Paying Employees

From 1 July 2019, you can only claim deductions for payments made to your workers where you have met the pay as you go (PAYG) withholding obligation for that payment.

More specifically, a business will only be able to claim a deduction for the following payments if they comply with the new PAYG withholding rules:

- Salaries, wages, commissions, bonuses or allowances to an employee.

- Directors’ fees.

- Payments made under a labour hire arrangement.

- Payments for a supply of service where no ABN has been provided by the contractor.

Where the PAYG withholding rules require an amount to be withheld, you must:

- withhold the amount from the payment before you pay your worker.

- report that amount to the ATO.

You won’t lose your deduction if you:

- withhold an incorrect amount by mistake – to minimise any penalties you can correct your mistake by lodging a voluntary disclosure in the approved form.

- withhold the correct amount but made a mistake when reporting – correct your mistake as soon as possible.

If there is a withholding or reporting requirement and no amount is withheld or reported to the ATO, you will lose your deduction unless you make a voluntary disclosure in the approved form before the ATO advises you that they have begun an examination of your affairs.

Withholding PAYMENTS – General Due Dates & Frequency for new s 26-105 ITAA 1997 non-deductibility risk purposes

Type of PAYG withholding payer Frequency of PAYG withholding payments First withholding payment which may create a non-deductibility risk for the underlying payment(s)

Small withholder

(<$25,000 withheld p.a.) Quarterly September 2019 Quarter Activity Statement due date

Medium withholder

($25,000 to $1 million withheld p.a.) Monthly July 2019 Activity Statement due date

Large withholders

(>$1 million withheld p.a.) Up to twice per week (depending on withholding payment date(s)) First week of July 2019 (subject to first withholding date for year)

Superannuation Issues

End of financial year would not be the same without superannuation being mentioned.

Below is a table highlighting how much superannuation can be contributed for FY19.

![]()

Regardless of the Super Fund type, for contributions to be claimable as a tax deduction in the FY19 year, the money must be deposited into the Fund’s bank account by 30 June 2019.

The contributions tax of 15% applies to all deductible contributions made to superannuation this financial year.

If you are over 65yrs and wish to make contributions to superannuation, you must make sure you pass the work test for FY19.

Transitional rules apply for “the bring forward” rule, for those members with account balances of $1.4m or higher.

Please note, that if you have a superannuation balance in excess of $1.6m you are no longer able to make non-concessional super contributions.

From 1 July 2018, individuals with adjusted taxable income greater than $250,000 will have tax payable on their concessional contributions increased from 15% to 30% (excluding the Medicare levy).

The information contained in this article is of a general nature and does not take into account personal circumstances. Before making any decisions based on the factual information contained in this article please consult with your financial adviser.

This article was contributes by Ian Walker – Director, Archer Gowland Chartered Accountants.

Leave a Reply