Insurance Premiums and Sinking Fund Levies – Construction Market Influences

Insurance Premiums and Sinking Fund Levies – Construction Market Influences

A common misconception within bodies corporate is that insurance premiums and sinking fund levies should increase with Consumer Price Index (CPI). Is this correct? Does it make sense? Well, no.

In this article we look into construction markets and how this data is used by quantity surveyors to develop Insurance Valuations and Sinking Fund Forecasts required for Bodies corporate to determine insurable values for the building policy and capital replacement costs determining annual sinking fund levies.

If we were to first look at insurance and ignore changes to the policy inclusions, insurance premiums are driven by the insurable value of the property. The insurable value is made up of many different allowances, including:

• The cost to re-construct the building, like for like

• The cost to demolish the structure and any left-over debris to make the site clear and ready for construction

• The cost for re-design and professional fees

• Escalation

These costs are all driven by the construction market and the fluctuations within this market. Even professional fees which are usually a percentage of the construction value are driven by fluctuations in the construction market. So, if your insurance premium has risen or, on the rare occasion fallen following completion of an insurance valuation, this is due to the construction market fluctuation in your state and local area.

Sinking fund levies allow for the reasonable raising of monies from lot owners to meet current and future capital replacement requirements. These costs whether they are plumbing, electrical, painting, lifts etc are all driven predominantly by the construction market. If your sinking fund levies are increasing in line with CPI instead of based on an up to date sinking fund forecast, your body corporate is at risk of not having enough money to meet capital expenditure requirements now and in the future.

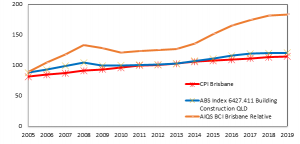

If we look historically at how the QLD construction market has behaved in comparison to CPI over the last 15 years, you can see that in fact the construction market has increased at a consistently higher rate than that of CPI.

This fact highlights the important of engaging a quantity surveyor who is a construction cost professional, to analyse the insurable value of your property and your sinking fund levies to ensure you are appropriately budgeting.

This article was contributed by Zac Gleeson, Quantity Surveying Consultant – Archers the Compliance Professionals.

Click here for the PDF version

Leave a Reply